We would like to bring your attention to the proposed amendments to the AIF Law and the AIFM Law set out in the Consultation Paper CP(2016-03) circulated by the Cyprus Securities and Exchange Commission on the 22nd of April 2016.

1.Introduction of a new AIF type: Registered Alternative Investment Funds

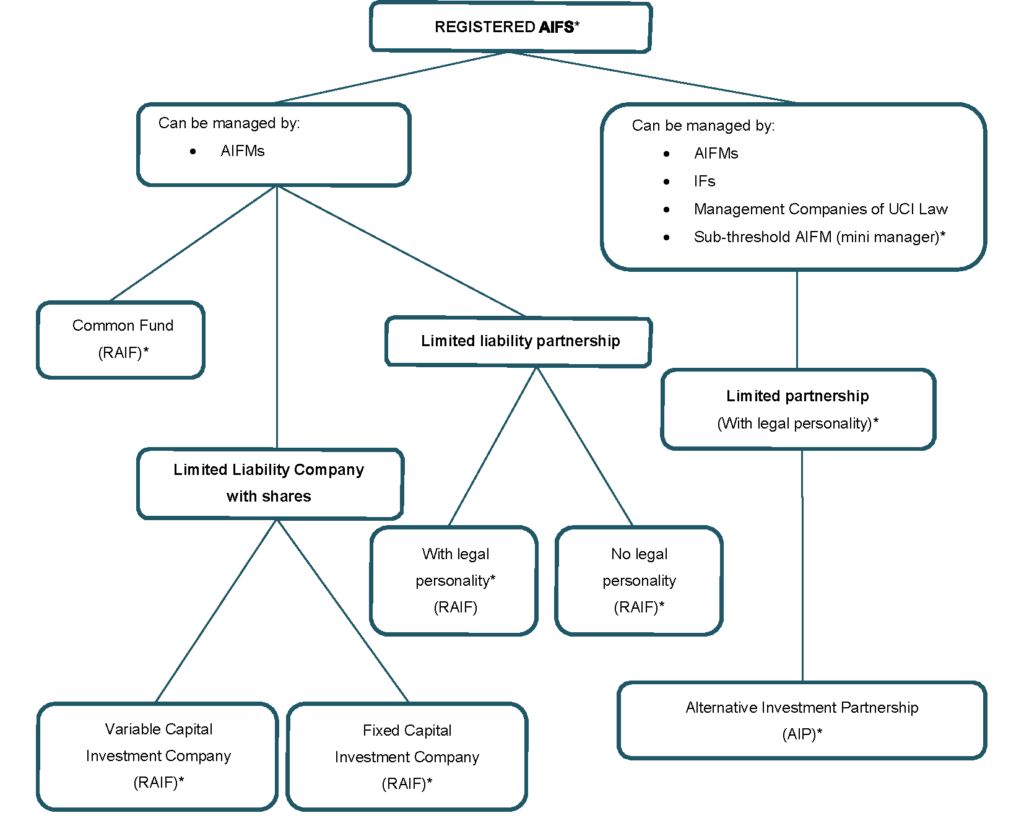

Registered AIFs may operate as open or closed-ended AIFs taking the following legal forms:

- investment companies (of fixed or variable capital), or

- limited partnerships, or

- common funds.

The newly proposed AIF type, Registered Alternative Investment Funds, is:

- not subject to authorisation/license by CySEC;

- subject to registration by CySEC;

- externally managed where the external manager must fulfil certain minimum regulatory criteria (AIFM licensed under the AIFM Law) and must appoint a depositary;

- supervised through its Manager who will undertake the production of investor prospectus and annual report;

- exclusively addressed to professional and well-informed investors;

- subject to capital requirements.

CySEC also proposes the introduction of Alternative Investment Partnerships, a Registered AIF that can assume the legal form of Limited Liability Partnership with legal personality. Such funds would operate as closed-ended vehicles investing in illiquid asset classes including real estate.

2.Introduction of Mini Managers

The European Directive 2011/61/EU provides that Member States may apply a lighter regime for:

- AIFMs where the total assets of the AIF under management fall below a threshold of EUR 100 million; and

- AIFMs that manage only unleveraged AIFs that do not grant investors redemption rights during a period of 5 years and where the total assets of the AIF under management fall below a threshold of EUR 500 million.

To this end, CySEC proposes the establishment of the Mini Manager i.e. Sub-Threshold AIFM for externally managing Alternative Investment Partnerships. The Mini Manager:

- can be a limited liability company with shares and registered office in the Republic, whose sole purpose is to manage an AIF;

- is subject to authorisation by CySEC;

- is subject to capital requirements;

- upon authorisation, is registered in the Special Registry maintained by CySEC and must fulfil minimum regulatory requirements with regards to fund management, risk management, disclosure to investors, compliance, internal audit, and other operational areas.

3.Registered AIFs Summary

Source: Annex C of the Consultation Paper CP(2016-03) circulated by CySEC on the 22nd of April 2016

*Upon amendment of the relevant legislation