Government officials and a growing number of investors believe the Federal Reserve’s interest rate rises will not damage the US economy significantly. But investment chiefs at two of the world’s largest asset managers are not so optimistic.

FT spoke to investment chiefs at two of the world’s largest asset managers, BlackRock and Amundi, who warned that the risk of a US recession is rising. They’re concerned that while the US economy has largely looked resilient in the face of aggressive monetary tightening by the Fed, cracks are now appearing, notably in the labour market.

“The probability of a recession for us is very high,” said Vincent Mortier, chief investment officer at Amundi, which manages $2.1tn. “The question mark is how deep and how long . . . We are much more concerned by the dynamics in the US than the consensus,” he said, adding that he expected the contraction to come at the end of this year or early next year.

Rick Rieder, chief investment officer of global fixed income at BlackRock, which manages $9.4tn, said he had become more pessimistic about the state of the US economy in recent weeks. While he thought the country would avoid a severe recession, he said a slowdown had already begun.

“We had been pretty enthusiastic about the economy. But now, ironically, when I think people have written off a recession . . . now I actually think we are seeing some tangible signs of slowdown. I don’t think you can write off a recession.”

Both are now “overweight” US government bonds in the belief that the Fed may already be done raising rates and that Treasuries would perform well during a period of economic weakness. Both also expect the dollar to fall.

Mortier said a weaker jobs market would sap consumer demand, putting pressure on corporate margins as companies lowered prices to compete for market share. “The US consumer is exhausted,” he said.

Meanwhile, he thinks corporate balance sheets will become more stretched as companies depleted their cash reserves and needed to refinance at higher interest rates. “There is a wall of refinancing coming,” he added.

Mortier also pointed to the high level of US government debt, which limited the ability for US authorities to increase support for the economy.

Amundi is shorting the dollar, although its CIO admitted it was a “tricky” bet given that the currency was a haven asset that could benefit during market shocks.

Higher rates and banking worries hit buybacks

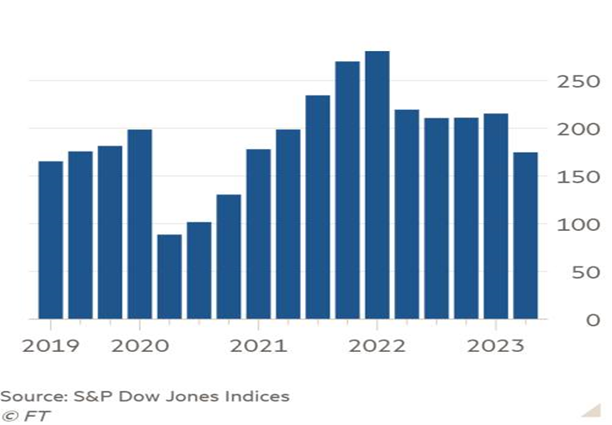

Quarterly share repurchases by S&P 500 companies ($bn)

Share buybacks on the US stock market have dropped to the slowest pace since the early stages of the Covid pandemic as rising interest rates undermine the incentive for companies to purchase their own shares, writes Nicholas Megaw in New York.

Companies in Wall Street’s benchmark S&P 500 index spent $175bn buying back shares in the three months to June, according to preliminary data from S&P. That marked a 20 per cent decline from the same quarter last year and a 19 per cent decline from the first three months of 2023.

Analysts say the slowdown is likely to mark the beginning of a longer-term trend that could put downward pressure on stock markets.

“Structural reasons as well as the interest rate environment are both contributors,” said Jill Carey Hall, equity and quant strategist at Bank of America. “We would expect buybacks to not be as big for the foreseeable future.”

Corporate buybacks have become an increasingly important but controversial part of stock markets in recent years. They can directly prop up share prices by adding to demand and also help improve profitability on an earnings per share basis by reducing the number of shares in circulation.

However, critics of share buybacks accuse company boards of using them to artificially inflate their share prices and reward senior executives instead of spending on long-term investment or increasing pay for lower-paid employees.

*Source: Financial Times Asset Management newsletter 18 September 2023