Consolidation in private equity is rife right now, with deals this month including CVC’s purchase of a majority stake in Dutch infrastructure investor DIF Capital Partners, and Bridgepoint’s acquisition of US-based renewables specialist Energy Capital Partners.

One leading European private equity firm has a particularly stark prediction for how this wave of dealmaking might whittle down the sector to a fraction of the number of players it has today, write my colleagues Chris Flood and Will Louch in London.

The number of private market fund managers will shrink to as few as 100 over the next decade as higher interest rates, fundraising challenges and increasing regulatory costs drive a massive wave of consolidation, reckons David Layton, chief executive of Partners Group which oversees assets of $142bn.

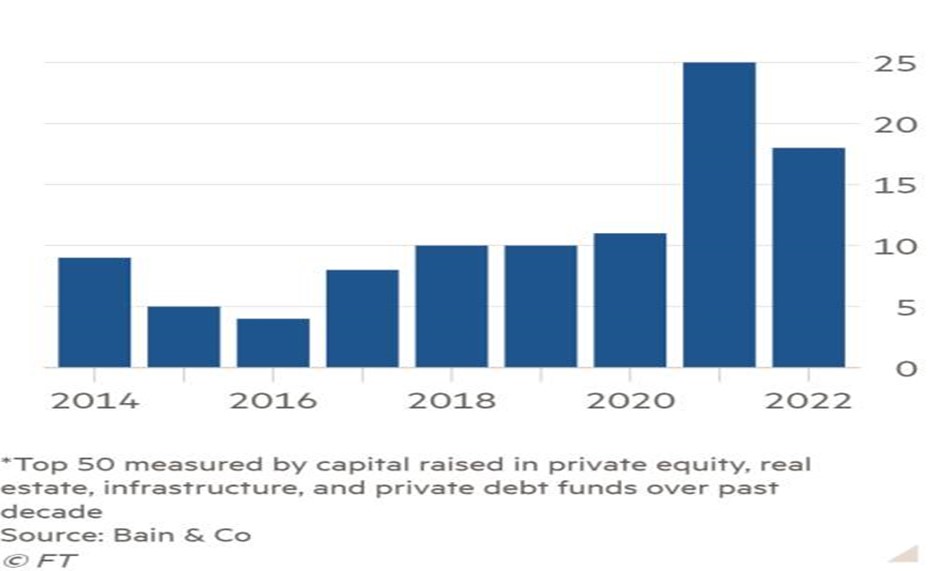

Private capital M&A

Number of acquisitions made by top 50 alternative asset managers globally*

Layton said in an interview that private markets had entered a “new phase of maturation and consolidation”. Managers responding to fundraising pressures in more difficult economic conditions and shifting towards wealthy individual clients as a driver of new asset growth, would drive a significant rise in mergers and acquisition activity.

Here’s how this could play out, says Layton:

“It is really only the large players that can withstand the forces reshaping the private markets industry. We could see the current 11,000 or so industry participants shrink to as few as 100 next-generation platforms that matter over the next decade.”

Assets held in illiquid private market strategies stood at $12tn at the end of December, according to consultancy Preqin. The firm estimated that total private markets fundraising dropped 8.5 per cent last year to $1.5tn with net inflows into private equity managers down 7.9 per cent to $677bn in 2022.

Many smaller PE managers have found the process of attracting new business increasingly difficult. The top 25 largest competitors have captured more than a third of the $506bn of new capital allocated to PE so far this year.

Layton added: “There is a real bifurcation between the managers that can raise money and those that cannot. This will accelerate the process of natural selection as the industry grows in size.”

*Source: Financial Times Asset Management newsletter 18 September 2023